There are many questions and concerns regarding insurance costs for breast reconstruction surgery. It’s important to know as much as you can about your insurance coverage options and whether the procedure will be affordable for you.

Continue reading as Tabetha, our dedicated Patient Liaison, and Jessie, our Cycle Revenue Manager, answer some of the most commonly asked breast reconstruction questions we receive at PRMA Plastic Surgery.

Does insurance pay for breast reconstruction?

Yes, most insurances cover breast reconstruction, however, this is based on the specific insurance policies and your individual benefits.

Are all insurance companies required to pay for breast cancer reconstruction?

Not all insurance companies are required to pay. However, thanks to the Women’s Health and Cancer Rights Act (WHCRA) of 1998, most group health insurance plans are obligated by federal law to cover reconstruction if they provide coverage for mastectomy.

What is the difference between a PPO and an HMO? Is there a different process for HMO policies as far as getting approval?

HMO stands for health maintenance organization and PPO stands for preferred provider organization. Both types of plans use a network of physicians, hospitals, and other health care professionals to provide you with the highest quality of care.

The biggest difference between the two is, HMO plans require a referral from a primary care physician to a specialist. Without a valid referral on file, an HMO plan will not pay the office visit or approve authorization for surgery.

Do you accept out-of-state insurance policies?

With the exception of Medicare and Medicaid, PRMA does accept out-of-state group health insurance policies as long as there is a contracted network for which to submit claims. Provided with a copy of your insurance card, PRMA’s patient liaison will be able to verify this detail.

Your website says you don’t balance bill, what does that mean?

PRMA does not balance bill our patients. Since we are in network with most major carriers, this means that we do not bill patients the difference between what the insurance plan allows and the amount that PRMA charges. This difference is written off and is known as a contractual adjustment.

Does insurance usually cover prophylactic mastectomy and reconstruction? Are there typically certain requirements you need to meet in order to be covered?

Prophylactic mastectomy is not a patient or law-protected procedure; however, many insurances do consider coverage based on their policies and will determine medical necessity prior to services.

How long does it usually take for insurance coverage to be verified for surgery? Is there a process it must go through?

The verification of benefits can range from just a few moments to a few hours, depending on the insurance. Pre-determination and/ or authorization can take up to 6 weeks depending on the insurance.

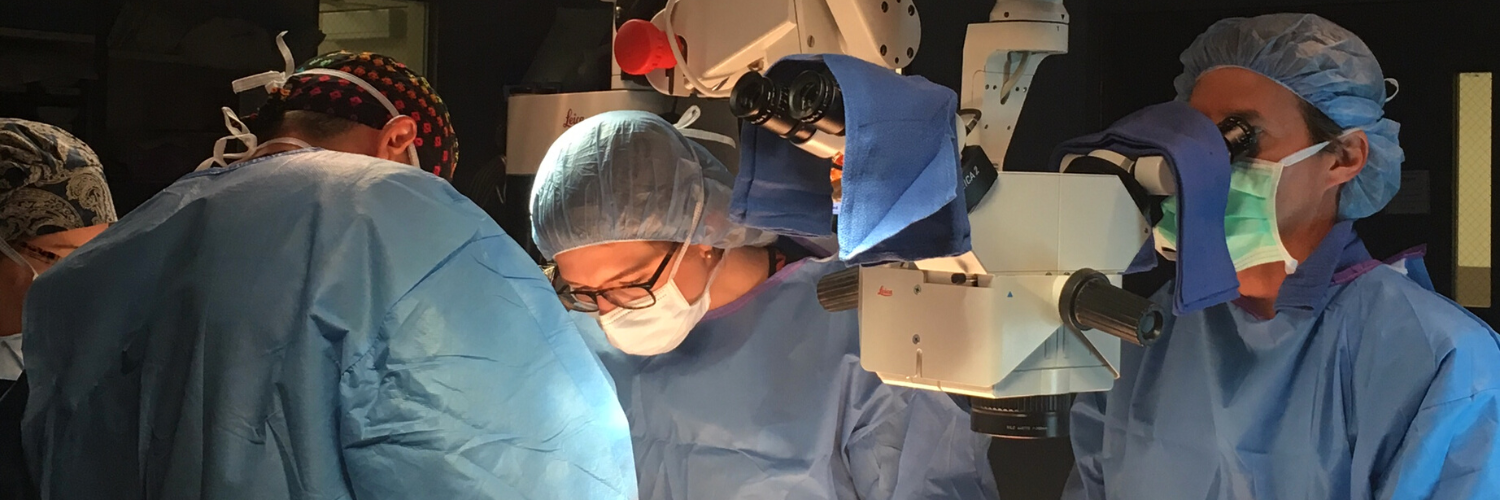

Are there certain types of reconstruction that aren’t covered by insurance?

Typically, no. Insurance policies for breast reconstruction all fall into the same policy.

I had breast cancer surgery many years ago, would insurance still pay for my reconstruction so many years later?

There is no deadline for a woman to decide on whether to have breast reconstruction. Time is not part of the criteria when determining medical necessity.

Why can’t you accept my insurance as out of network if I have out-of-network benefits?

PRMA can only submit claims to an insurance if there is a contract with the network it utilizes for the processing of claims.

What are my out-of-pocket costs if I go to an out-of-network surgeon?

PRMA patients with insurance policies considered out of network can be provided with a cash quote which can vary dependent upon the established surgical plan. Most patients may be able to submit payment receipts to their insurance directly for possible member reimbursement but due to a lack of contract, will not be able to determine a patients out of pocket costs. PRMA’s billing department may be able to assist in the post-surgical reimbursement process.

Is there a limit to the amount of coverage provided?

Most group policies have a lifetime maximum that is unlikely to be met. There are also policies that limit the amount of coverage provided.

Is my hospital stay covered?

PRMA schedules surgery with locations that have similar contracted insurance network which allows your hospital stay to be covered by your insurance.

How many revision surgeries are covered by insurance?

Like all surgeries, insurance coverage is based on medical necessity and is reviewed on a case-by-case basis.

If you have any further questions about insurance coverage and breast reconstruction, leave a comment below and we will get back to you!

“Set realistic, attainable goals after your surgery. Your body is going to feel different now than it did before surgery. If you are doing it simply to lose weight or get back into a certain dress or pant size you may be setting yourself up for failure. Reset your compass.”

No Comments